Marel enjoys improved revenue, market conditions in Q2 2023

Gardabaer, Iceland-based Marel saw an overall improved year-over-year revenue in Q2 2023 and improved market conditions, but the company’s seafood division suffered from lower orders.

The company posted revenue of EUR 422.4 million (USD 463.3 million) in Q2 2023, up 6.3 percent year-over-year from EUR 397.3 million (USD 435.7 million) posted in 2022. Gross profit also increased by 11.3 percent year-over-year to EUR 148.2 million (USD 162.5 million), from EUR 133.1 million (USD 145.9 million). For the first half of the year, revenue is up 13.1 percent over 2022, reaching EUR 869.8 million (USD 954 million); while gross profit is up 15.8 percent to EUR 309.4 million (USD 339.3 million).

Marel's earnings before interest, taxes, depreciation, and amortization (EBITDA) in Q2 2023 increased year-over-year by 29.6 percent to EUR 49.9 million (USD 54 million), up from EUR 38.5 million (USD 42.2 million).

A key performance indicator for the company, orders received, also increased for the quarter to EUR 407 million (USD 446 million), up from what Marel CEO Arni Oddur Thordarson called “low levels” of EUR 363 million (USD 398 million) in Q1 2023.

“We are seeing increased sales activity and the pipeline continues to firm up,” Thordarson said.

Thordarson attributed the increases to continued struggles with labor, coupled with wage inflation, which is forcing processing companies to explore greater use of automation.

“Marel is in a pole position to navigate the future in partnership with our customers,” Thordarson said. “We believe orders received will be strong in the second half of the year, although timing of conversion from pipeline to orders can fluctuate.”

Marel's overall performance was slightly hampered by lower orders in past quarters, the company said. While orders in Q2 2023 were up for the company’s poultry; meat; and plant, pet, and feed segments; Marel Fish was the one segment hit by declines. It saw revenues of EUR 50.4 million (USD 55.2 million) in Q2 2023, down from the EUR 52 million (USD 57 million) it posted in Q2 2022. The segment – which makes up 12 percent of the company’s total revenues – saw a negative EBIT margin of 5.6 percent, which the company said was “below expectations,” and saw losses of EUR 2.8 million (USD 3 million).

“Management continues to target short-term EBIT margin expansion for the fish segment, based on right sizing actions already enacted and continued focus on operational efficiency,” the company said.

The company said Marel Fish's near-term future outlook for orders is more positive for the segment.

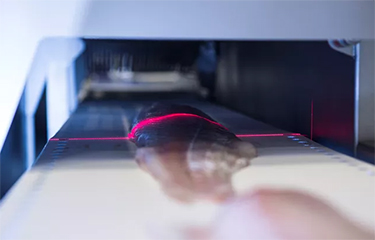

“Marel was prominent at the Seafood Processing Global exhibition in Barcelona in April, one of the key trade shows for fish processing, demonstrating our latest innovative technology to processors from across the world,” Marel said.

Overall, Thordarson predicted that demand for “proactive and predictive service” would continue to increase, which will benefit the company’s performance moving forward.

“Based on our transformative investments in the spare parts journey and digital services, we are confident we can continue to deliver growth in aftermarket revenues with increased productivity going forward,” he said.

Photo courtesy of Marel

Share